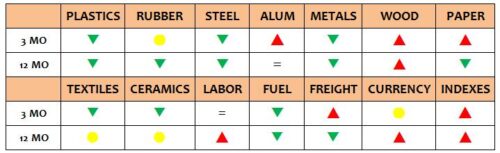

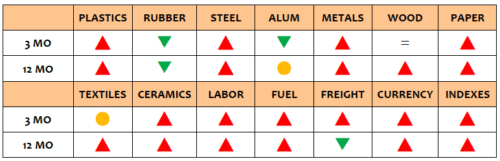

Asia Manufacturing Showed Signs of Improvement in Q4-2022

ASIA MANUFACTURING COST DRIVERS REPORT Q4– 2022 (Oct. Nov. Dec.) Tracking The Trends Which Drive Costs in Asia Manufacturing Executive Summary Despite supply headwinds, labor shortages, and an uncertain economic environment, Asia manufacturing continues to surpass the expectations of recent years. Manufacturing has demonstrated continued strength in 2022, building on the momentum it gained emerging […]