Manufacturing Cost Drivers Report For Q3 2020

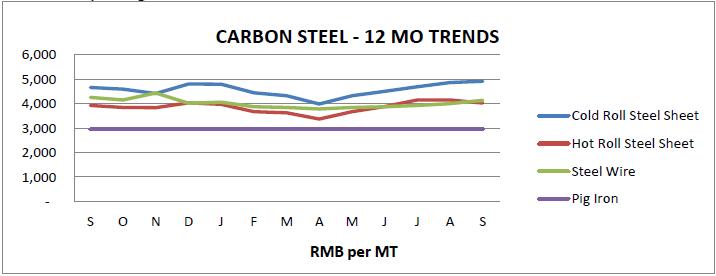

The commodity price trends in the third quarter were increased in Asia. Most of grades were increased in Rubber, Steel, Alum, Other metal, Paper, Ceramics, Fuel, Freight. Only Plastics was down in price in this quarter. Wood, Textiles were mostly flat in price, and Labor rates were steady in the lower wage countries. The Currency was down in this quarter too, US Dollar was down about 3% of the CNY then last quarter. The trend for World Container Index was increased in Q3. Both China imports and exports were increased. The China CPI was kept flat, the China PPI was increased slightly. The China PMI indexes were kept flat in Q2, the US PMI was up 5% in Q3. Below is a chart of the general trends and for all the details, please see the entire report.

PLASTICS & RUBBER

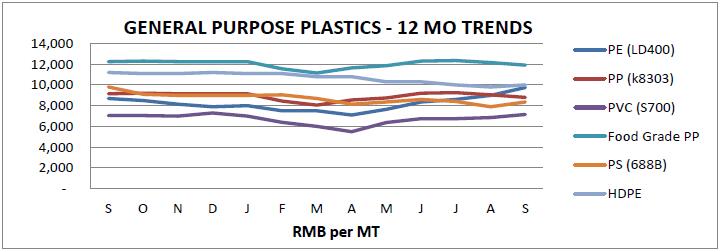

Most General plastic prices were up in Sept, especially PE (LD400) was up 8.33%. Year over year, most of general plastic prices were down on average of 21.7%, PP (k8303) was down 3.8%, Food Grade PP was down 2.9%, PS (688B) was down 14.8%. However, PVC (S700) was up 1.4%, PE (LD400) was up 12.1% than last year.

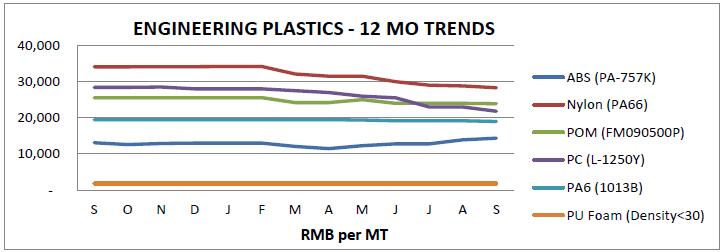

Some of engineering plastic prices were down in the Third quarter, only ABS (PA-757K) increased 12.5%. PC (L-1250Y) was down 14.5%. Year over year, PC (L-1250Y) was down 23.2 %, following is Nylon (PA66) down 17%. ABS (PA-757K) increased 9.9%. PU Foam (Density<30) kept flatly.

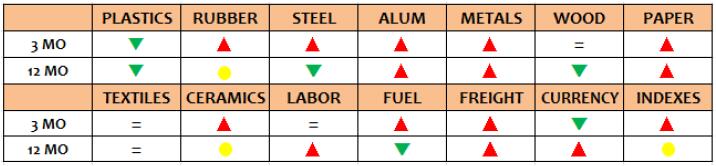

Most of the Rubber prices were increased in Q3, Polybutadiene Rubber (BR9000) was up 6.1%, Natural Rubber (SCR5) increased greatly by 20.8%, EPDM Rubber was up 7.5%. Year over year, Polybutadiene Rubber (BR9000) was down 29.8%, and EPDM Rubber was down 5.3%. Natural Rubber (SCR5) increased 9.9%.

METALS

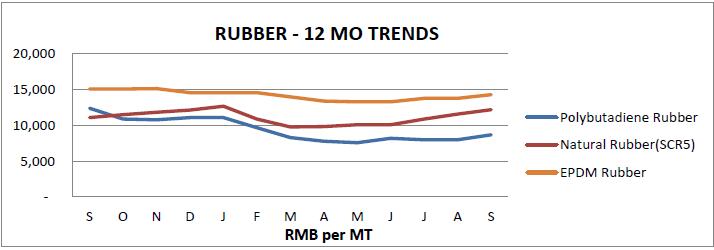

For the third quarter of 2020, the prices for most of Carbon Steel were up. Cold Roll Steel Sheet was up 9.1%, Hot Rolled Steel Plate increased 3.6%, and Steel Wire was up 6.7%. Pig Iron was steady. Year over year, most of carbon steels in prices were up on the average 1.2% versus one year ago.

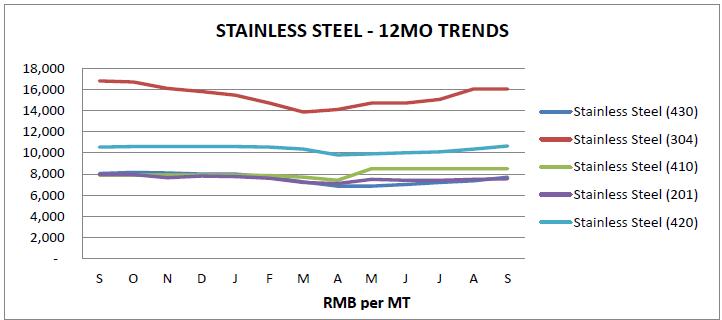

In the Stainless Steel part, most of the grades of prices were up in the third quarter, with 430 increased 10%, 304 increased 9.2%, 201 up 2.0% and 420 up 6.5%, 410 kept flatly. Year over year, 410 increased 7.6%, conversely, 430/304 and 201 was down about 5% versus one year ago.

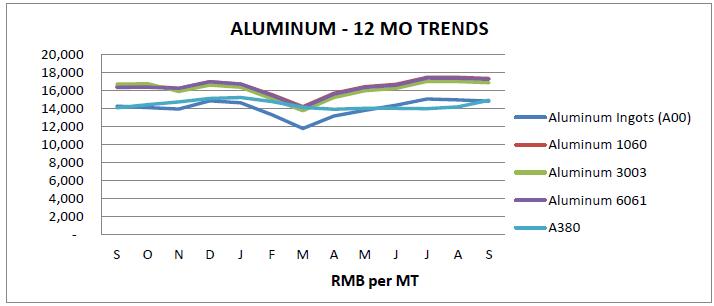

The aluminum prices were up on the average of 4.6% in the third quarter. Year over year, all aluminum prices increase on the average 4.6% as well versus one year ago.

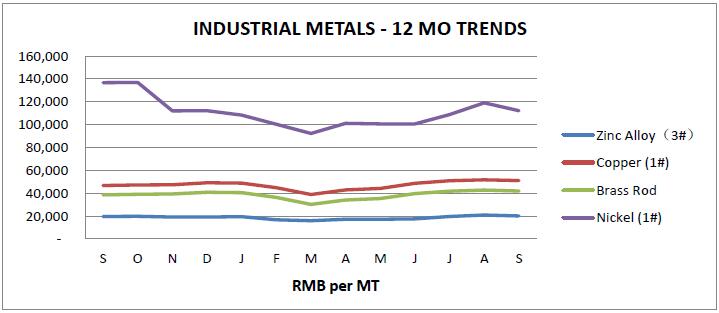

In other Industrial Metals, the trend was up in Q3, average up 7.8%, especially, Zinc Alloy increased 14.4%, Nickel increased 11.4%. Year over year, Copper and Brass Rod was up on average 8.7%, Zinc Alloy was up 2.5%. Conversely, Nickel was down 18% versus one year ago.

WOOD, PAPER & TEXTILES

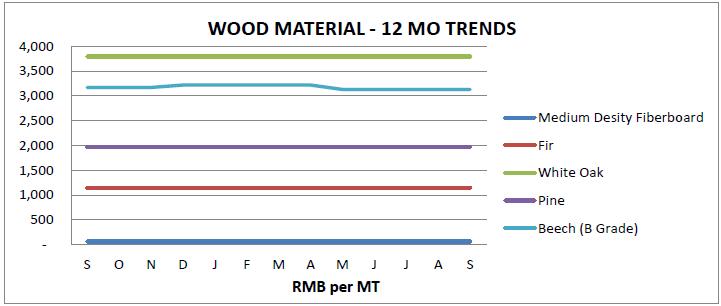

Wood prices were steady in Q3.Year over year, most of wood prices were slightly down by average 0.9% versus one year ago.

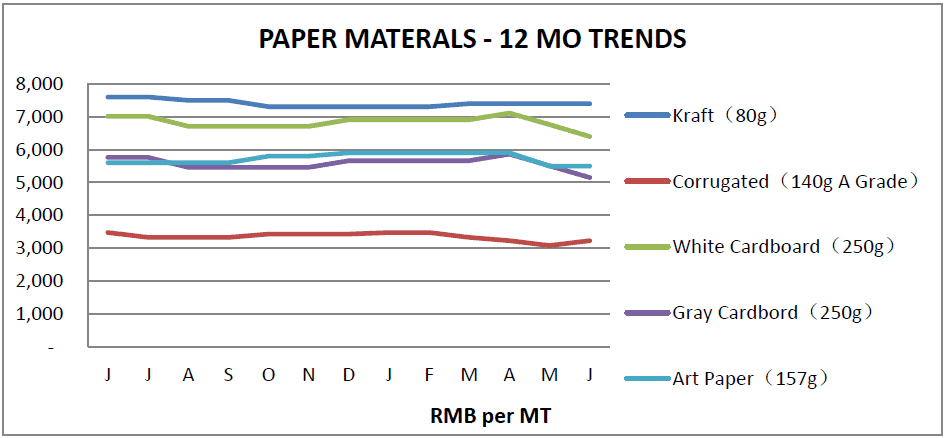

Most of the prices of Paper Materials were up by average 7.3%, Kraft Paper and Art Paper were kept steady. Year over Year, Kraft Paper and Art Paper were down 1.5%. Conversely, Corrugated was up 12%, White and Gray Cardboard were up 5% versus one year ago.

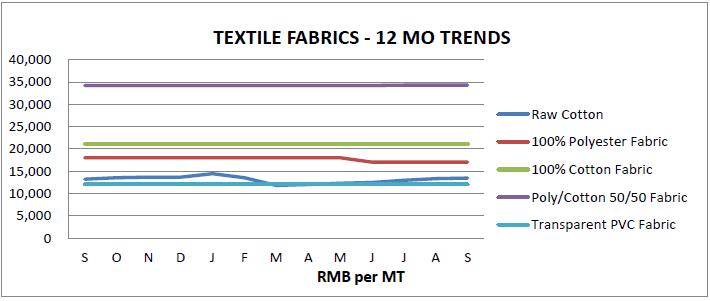

Textile fabric prices were mostly unchanged in the third quarter, except Raw Cotton in price was up 8.1%. Meanwhile, year over year, most of Textile prices keep steady, while Raw Cotton was up 1.7%, 100% Polyester Fabric was down 5.6% respectively versus one year ago.

CERAMIC AND GLASS RAW MATERIALS

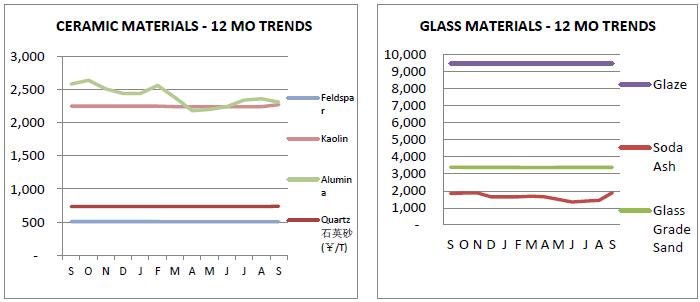

In Ceramic and Glass Raw Materials, most of the materials were up in Q3, However, Soda Ash obviously increased 40.7%, was bounce back half from last quarter (dropped 20.6% in Q2), and followed by Alumina in price were up 3.1%. Year over year, Soda Ash was up 2.7%, and Alumina are down 10.5% respectively versus one year ago.

FUEL

Fuel prices in China were increased in this Q3, with Petroleum Price was up 36.3%, LGP gas was up 10.5% and Natural Gas prices was up 9.1%. Conversely, China Industrial Electric was down 9.5% and China Diesel Oil down 5.4%. However, year over year, the trend for the grades were down in prices on average 23.4% versus one year ago.

OCEAN FREIGHT

The World Container Index was up 42.8% in the third quarter. Year over year, the World Container Index was up 112% versus one year ago.

COST OF LABOR

Most of the Asian labor rates were unchanged in Q3. Year over year, Indonesia and Vietnam were up 8.6% and 5.7% respectively.

CURRENCY EXCHANGE RATE

For the third quarter, the USD was weakened against the CNY by 4.79%, against INR and TWD on average 2.68%. The USD was strengthened slightly against IDR by 2.73%. Year over year, the USD was weakened against the CNY/INR/TWD by average 6%. The USD strengthened against IDR 4.01% and against THB by 2.51%.

CHINA TRADE (Data lags by one month)

China Imports was up 21.3%, and at the same time, China Exports was up 12.26% in the third quarter. Year over year, China Imports increased 13.65% and Exports increased 9.93% versus one year ago.

The China Consumer Price Index (CPI) was kept steady. And China Producer Price Index (PPI) was down by average 1.77% in the third quarter. Year over year, the China CPI is down marginally 0.39% and China PPI was down 1.2% versus one year ago.

PURCHASING MANAGERS INDEX (PMI)

The PMI China was up 1.18%, PMI Hong Kong was up 4.73%. PMI US was up obviously by 5.32% in Q3. Year over year, PMI China was up 3.41% and Hong Kong was up 5.36%, PMI US was up 15.9% versus one year ago.

CONTACT US FOR MORE INFORMATION

Thank you for taking the time to follow trends in Asia manufacturing. Source International has operational offices in Louisville, Kentucky & Xiamen, China. Our passion is to partner with companies in supply management from Asia. We have a 27 year on-the-ground track record, a rigorous operating procedure, and a very well trained local staff. We welcome the opportunity to show you how we can add value to your supply chain in Asia and invite you to visit our offices and website to learn more about us.

For additional details, please refer to the charts that follow or contact one of our Operations Specialists for more information. Thank you for your support.

Visit our :www.sourceint.com

Data for this report comes from the sources listed and while every attempt is made to be as comprehensive and accurate as possible, please consider that these are just general trends and you should not draw any specific conclusions from the data. We recommend that any information provided in this report be weighed against other sources and experts on the individual topics covered and, accordingly, we make no specific claims nor assume any liability from the use of the data contained herein.