Asia Manufacturing Costs Rose Higher in the First Quarter of 2022

Asia Manufacturing Costs Rose in the First Quarter of 2022

Tracking The Trends Which Drive Costs in Asia Manufacturing As

Q1– 2022 (Jan, Feb, Mar)

EXECUTIVE SUMMARY

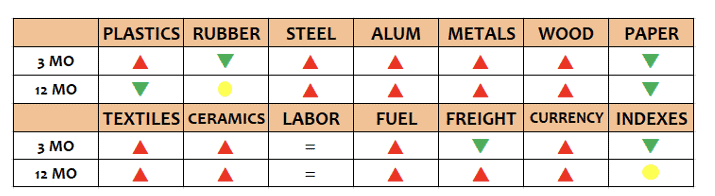

Manufacturing costs trended sharply upward in the first quarter of 2022. Most grades of Plastics, Steel, Alum, Metals, Wood, Textiles, Ceramics increased along with costs for Fuel, and Currency. Only Rubber and Paper decreased in the quarter along with Freight costs which declined 4.8% from elevated levels in most of 2021. The cost of Labor was flat in most Asian countries but rose sharply in China by 4.4%. The major manufacturing Indexes indicated slowed growth and contracting economies with the China PMI index down slightly by 1.6%, while the US PMI was down 2.7% in Q1 vs Q4 of 2021. In China, the largest sector of Asia manufacturing, by far, Imports decreased 6.9% and Exports showed a 18.9% decline versus Q4 2021 levels, while the PPI was down by 1.8% and the CPI showed little change.

Continued COVD shutdowns and the war between Ukraine and Russia are expected to put continued pressures on supply and demand for the balance of 2022.

For all the details please see the entire report that follows:

Asia Manufacturing Costs Moderated in Q4-2021

PLASTIC RESINS & RUBBER

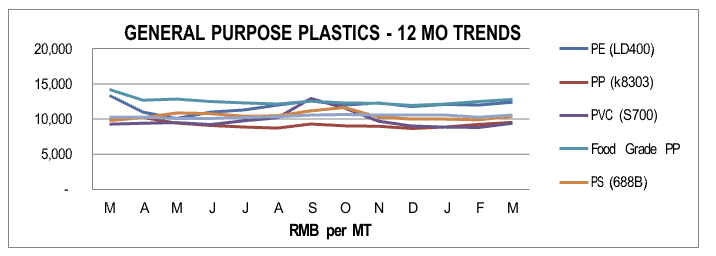

Most General Purpose plastic resin prices were up in the quarter on average by 3.3%. EVA lead the pack up 10.9%, followed by PVC up 6.8%, and PET up by 5.6%. Year over year, the results are mixed, with some plastic prices were up sharply and some down versus the elevated 2021 levels. PE and HIPS were down over 7%, PP was down 5.5%, Food Grade PP was down 9.8%, while EVA was up the most at 19.5%, PS was up 6.1%, and HDPE was up 3.9% versus Q1 of 2021.

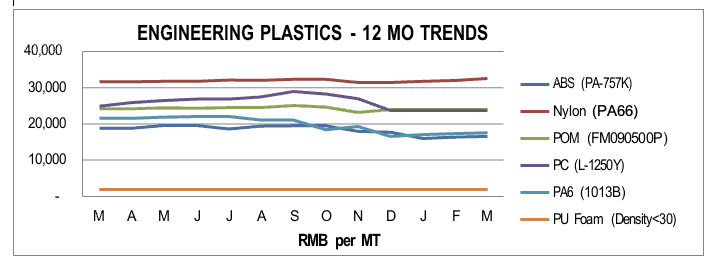

The Engineering Grade plastic resins fared better up on average by less than 1% versus Q4 of 2021. The main movers were Nylon up 6.1% and ABS down 6.8%. Year over year, prices were down on average by 4.9% with Nylon up 2.5%, while ABS was down 12.2%, Nylon down 18.6$, and POM decreased 0.83%, PC decreased 4.8% versus year ago levels.

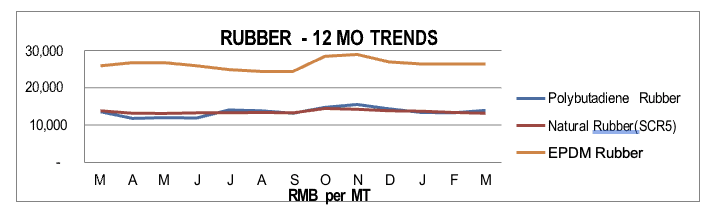

Rubber prices in Q1 the price trends were mixed. Neoprene Rubber was up 18.6% and NBR up 9.4%, while Silicon Rubber was down 11.8%, Latex and Natural Rubber were down 5.5% and 4.3% respectively. Year over year, rubber prices are up on average by 5.8% with Neoprene up almost 46%, Nitrile Rubber up 27.3%, and EPDM Rubber up by 1.9%, while Latex Rubber was down 5.8%, and Reclaimed Rubber was down 2.6% versus 1 year ago levels.

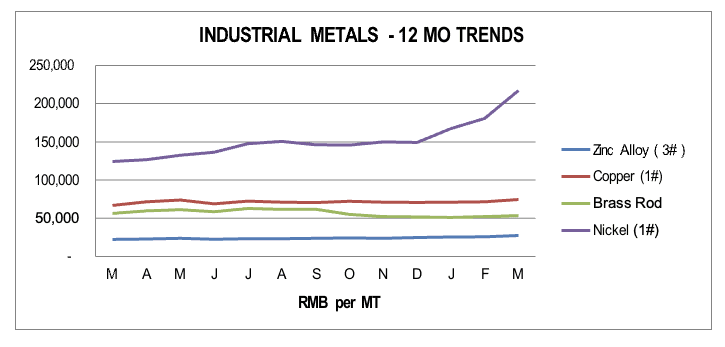

STEEL, ALUMINUM, AND OTHER INDUSTRIAL METALS

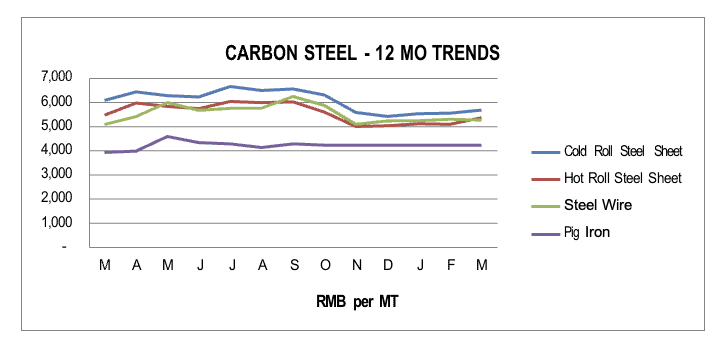

For the first quarter of 2022, most grades of Carbon Steel continued their upward trend on average 3.5%% versus last quarter. Cold Roll Steel Sheet was up almost 5%, Hot Rolled Steel Sheet was up 6.5%, while Pig Iron remained flat. Year over year, most of carbon steel prices were up on the average 3.6% versus one year ago lead by Tinplate up 18.8%, Cold Rolled Steel Plate up 7.4%, and Hot Rolled Steel Tubes up 6.8% as a result of Pig Iron up 7.6%in the quarter.

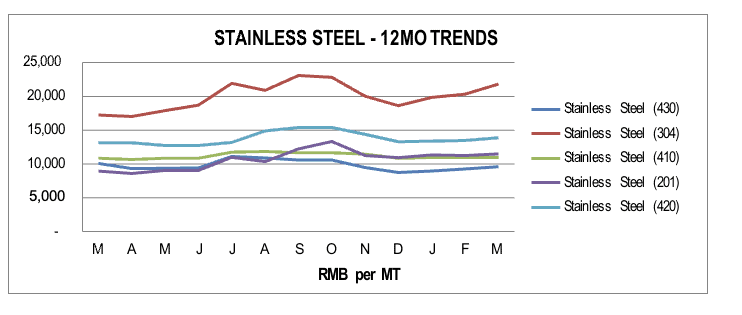

Stainless Steel prices also rose for most grade on average of 7.9% versus last quarter. Grades that rose the most were 304 Sheets up 17% and 430 Sheets in China and 304AND 430 in Vietnam up 18.3% and 10.8% respectively. Year over year, stainless grades were up almost 14% on average with China prices for 304 up 26.2%, 201 up 28.7%, and 420 up 5.8%, while only 430 was down 5% and in Vietnam, 304 was up almost 32% and 420 was up almost 10%, while 430 was down a little over 2%, versus one year ago.

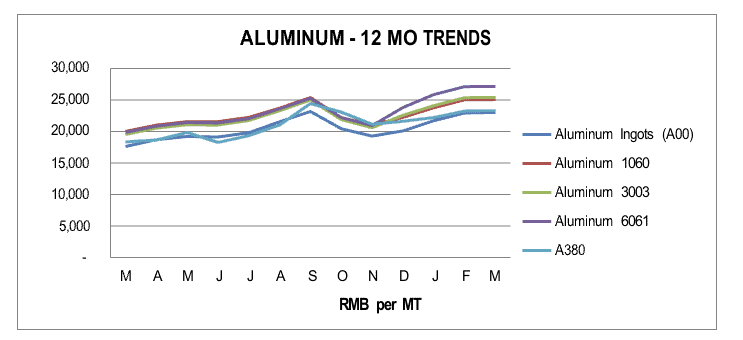

Aluminum prices also continued their upward trend, up on average by 11.9% versus Q4 of 2021 led by 6061 up 14% and 1060 up 12.6%. Year over year, all aluminum prices increased sharply on the average 29.1% versus one year ago. A00 Ingots were up 30.7%, 1060 up 25.1%, 3003 up 29.8%, 6061 up 36.7% and A380 up 27.4%.

In other Industrial Metals, the trend was up in Q1 on average 15.5% led by a sharp increase in Nickel prices of 46% followed by Zinc up . Year over year, Industrial metal prices were up on average of 23.8% with Nickel increasing the most up 76.2%, followed by Zinc Alloy up 22.1%, Copper up 11.7%, while Brass Rod decreased 5.7% versus one year ago.

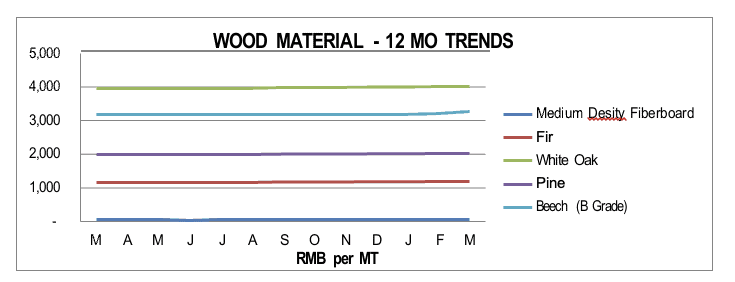

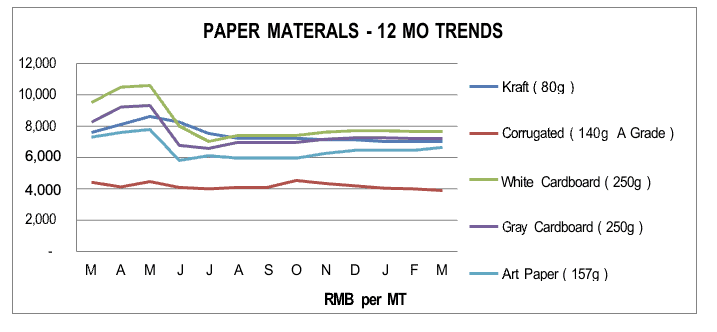

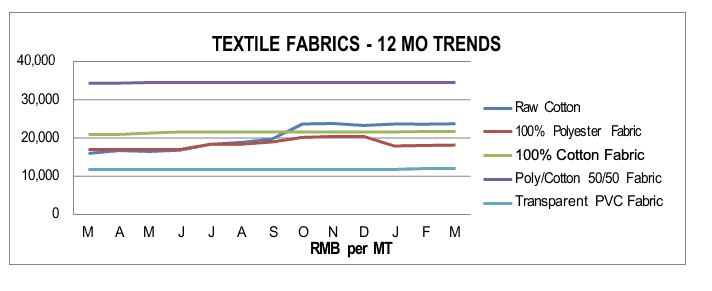

WOOD, PAPER & TEXTILES

Wood prices increased slightly in Q1, up on average by about 1.5%. MDF board was up the most at 2.8% followed by Beech and Birch up over 2% versus the last quarter of 2021. Year over year, wood prices are mixed with Fir was up 3.5%, White Oak up 1%, Pine up 2%, Birch up 2.3%, and Beech up 2.2%, while MDF showed increases and decreases in specific grades versus one year ago.

Paper prices were mostly positive in Q1 declining on average by a little over 1%. Corrugated dropped the most, down 7.1% versus last quarter. Year over year, the decrease is steeper with prices. Declining an average of 12.1%/. Kraft was down 7.2%, Corrugated was down 12%, White Cardboard was down 19.6%, Gray Cardboard was down 12.8% and Art Paper was down 8.9% versus the elevated prices from one year ago.

Textile Fabrics were up in price slightly by 0.6% on average in the first quarter, with Nonwoven PP up 2.9%, Raw Cotton up 2%, and T/C Fabric up 1.5%, while 100% Polyester Fabric declined in price by 10.8%. Year over year, prices are up on average about 5%, led by Raw Cotton up over 48%, 100% Polyester Fabric up 6.7%, and Nonwoven PP up 3.9% versus one year ago.

CERAMIC AND GLASS RAW MATERIAL

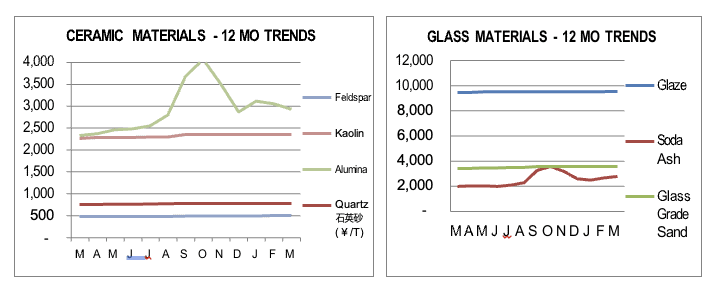

Ceramic and Glass Raw Materials kept steady in the quarter except for Soda Ash which continued its climb upward by 7.7%. Year over year, most prices were up or unchanged with Soda Ash up 40.0%, Glass Grade Sand up 6.2%, and Glaze up 0.8%, while Feldspar, Alumina, , Kaolin, and Quartz process were flat versus one year ago.

FUEL, FREIGHT, LABOR, AND MORE

FUEL

Fuel prices in China continued their move up in price on average of almost 19% versus last quarter, with Petroleum up 25%, Natural Gas price up 23% and LGP Gas up 29%. Year over year, the trend is the same showing an average 45% increase with Petroleum up 64%, Natural Gas price up 58% and LGP Gas up 63% versus one year ago.

OCEAN FREIGHT

The World Container Index showed freight prices down 4.8% versus Q4 of 2021. Year over year, the World Container Index was up 67% versus one year ago reflecting the sharp move up in freight prices over the past 12 months.

COST OF LABOR

Most Asia labor rates were unchanged in Q1, except in China where labor increased over 4, which is pretty much the same case year over year. Upon the return of the labor force to work following COVID shutdowns in many countries is expected to add additional inflationary pressures.

CURRENCY EXCHANGE RATE

For the fourth quarter, the USD was 1.&% stronger against CNY and slightly weaker against the Vietnam Dong versus last quarter. Year over year, the USD stronger against CNY by 2.2% and stronger against the Vietnam Dong by 1.7% while weaker by 11.5% against the Thai Baht.

CHINA TRADE

China Imports decreased 6.9% and Exports showed a 18.9% decline versus Q4 2021 levels. Year over year, China Imports increased only 0.7% and Exports increased 14.5% versus one year ago. The China Producer Price Index (PPI) decreased 1.8% top end the quarter at 108.3 while the China Consumer Price Index (CPI) showed little change in the quarter. Year over year, however, the China PPI was up more than 88%and the CPI was up only slightly at 1.1% versus one year ago.

PURCHASING MANAGERS INDEX (PMI)

The China PMI was slight down 1.6% in this quarter while the US PMI was down 2.7% in Q1. Year over year, PMI in China was down 4.6%, in Hong Kong down 4.9%, and in the US it was down 11.7% versus one year ago.

COVID UPDATE – CHINA & VIETNAM

The strict “Zero Tolerance” COVID policy in Vietnam and China has led to extended lockdowns and production interuptions. While China remains off limits ot foreign visitors, Vietnam has opened limited visa for foreign business people to travel there within certain testing and quarantine policies. A complete article on the situation there is at this link.

CONTACT US FOR MORE INFORMATION

Thank you for taking the time to follow the Source International has operational offices in Louisville, Kentucky; Xiamen, China; and Ho Chi Minh, Vietnam.

Our passion is to partner with companies in supply management from Asia. We have a three decade on-the-ground track record, a rigorous operating procedure, and a very well-trained local staff. We welcome the opportunity to show you how we can add value to your supply chain in Asia and invite you to visit our offices and website to learn more about us.

For additional details, please refer to the charts that follow or contact one of our Operations Specialists for more information. Thank you for your support.

Visit our :www.sourceint.com

Comments are closed