ASIA MANUFACTURING COST DRIVER REPORT-2018 Q1

ASIA MANUFACTURING COST DRIVER REPORT-2018 Q1

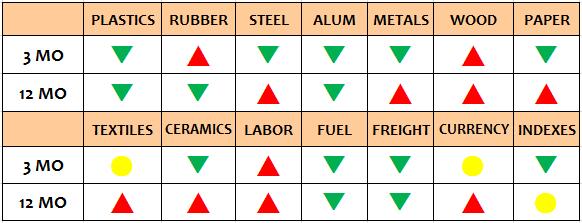

In the first quarter, there was a clear commodity price trends with most of raw materials in Asia going down in price. Many grades of plastics, steel, aluminum, paper, ceramic raw materials and other industrial metals went down in price while rubber and wood mostly rose in price. Textiles prices meanwhile remained mostly flat. Petroleum and fuel prices backed off their sharp increases and labor rates up in the lower wage counties. The US Dollar lost a little bit of ground against some of the Asian currencies in Q1. China Imports and Exports both saw significant decreases in the quarter and the China CPI was up slightly while the China PPI was down. Furthermore, PMI index remaining above 50 and signaling an expanding economy. Below is a chart of the general trends and for all the details, please see the entire report.

PLASTICS & RUBBER

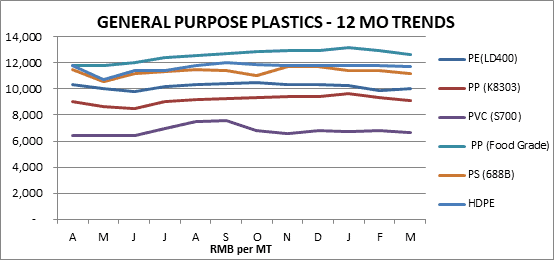

Most of the General Purpose plastic resin prices were down in the first quarter with PE, PP, PVC, PS, Food Grade PP and HDPE down marginally and only EVA up in price by 1.5%. The others remained steady. Year over year, most plastic prices remain down in price versus one year ago. PS is down the most (close to 10%) followed by PE and PP which are both go down in price by over 6%. PP is only GP resin which is up in price by 2.8% versus one year ago.

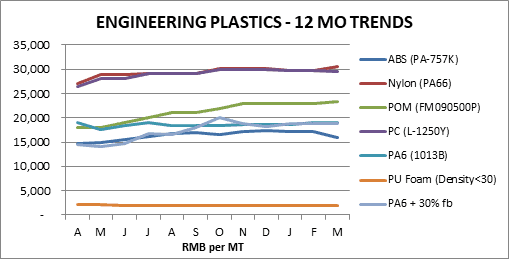

Engineering plastic resin prices were mixed in Q1 with ABS prices drop the most by 7.5% and PC and PU Foam down slightly, while the others were all up slowly. Year over year, POM is up a whopping 30% followed by PC up over 11% and ABS relatively increase a little, while PU Foam, PA6 and Nylon show a decreasing tendency versus one year ago.

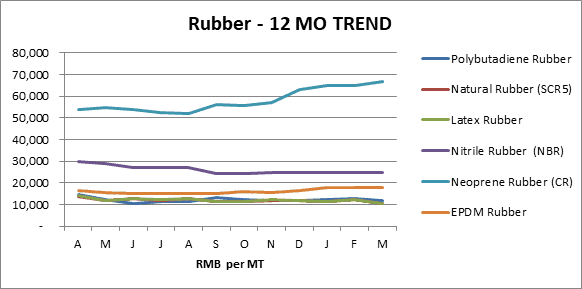

In the Rubber category, prices were mixed in Q1. SCR5 and Latex finally saw a drop in price, down almost 13 %, while Silicon Rubber and EPDM were up in price by 10% and 9% respectively following by CR increase by 6%. NBR was the only one remained unchanged. Year over year, except for CR shoot up in price by 30%, EPDM is up by 5.9%. Polybutadiene Rubber, SCR5 and Latex are all up on average 30% and NBR by 10.7% versus one year ago.

METALS

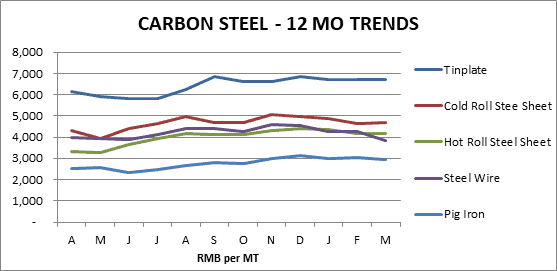

For the first quarter of 2017, all grades of Carbon Steel were down in price with Steel Wire and Steel Rib were down over 15% and the others decrease marginally. Year over year, the trend is most grades of Carbon Steel go up in price with Hot Rolled Steel Plate up over 23% following by Hot Roll Steel Sheet and Tinplate up by 15% & 9.8%, and the rest are go up marginally. Steel Wire is exception with a slightly decrease in price.

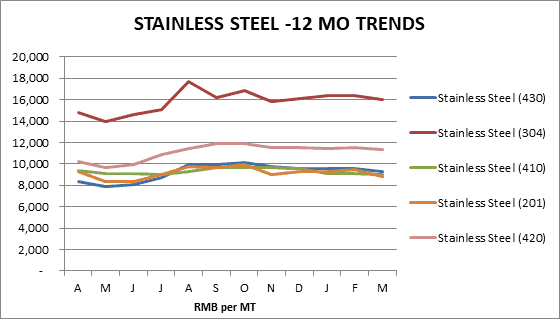

In addition, all grades of Stainless Steel still continued their down in price in the first quarter between 0.6% – 5.8% with 410 grade down the most. Year over year, the trend is mixed with 201 grade and 410 grade are go down in price by 11.5% and 6.3%, while the rest are go up on average 4.8% versus one year ago.

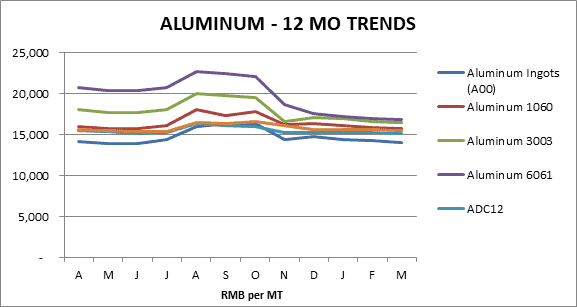

Moreover, all aluminum grades drop in price 3%-5.5% in the first quarter. And year over year, Aluminum 6061 go down in price by almost 17% and Aluminum down by 6.3%, while A00 and Aluminum 1060 are slightly higher in price.

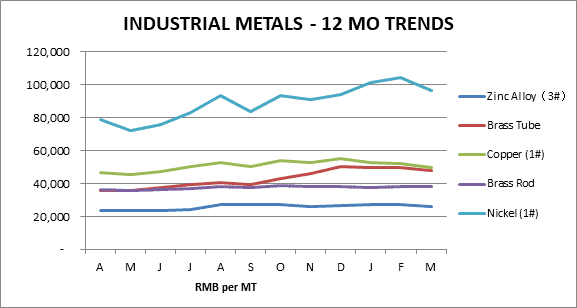

And, in Other Industrial Metals, only Nickel’s price was up in Q1 while the rest of metals were down in price. Copper increased by 9.8% and Brass Tube decline 5%. Year over year, all the metals prices are increase with Zinc up sharply by over 31% and Nickel up over 16% versus one year ago.

WOOD, PAPER & TEXTILES

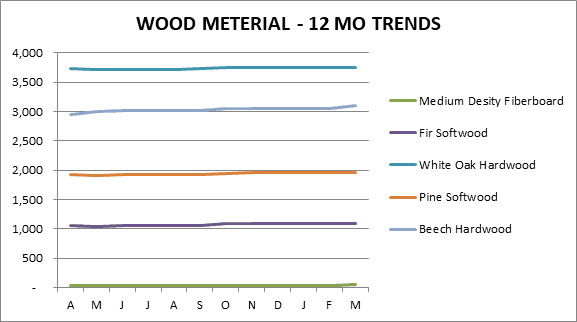

MDF increase by 9.5% in price and Beech Hardwood slightly higher in Q1 and the rest had no changed. Year over year all the prices are go up with MDF rise the most by over 24% and the others up slightly.

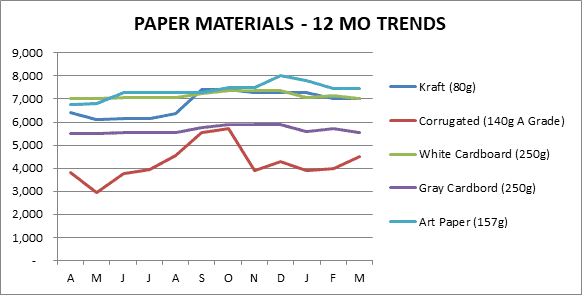

At the same time, Corrugated Board continued rise while the others saw a little change in the first quarter, all were relief on average 5.4%. Year over year, all paper prices remain higher, with Corrugated Board remaining up by almost 21% in price followed by Art Paper and Kraft rise by 15.5% and 14.8% respectively. Gray and White Cardboard only go up marginally versus one year ago.

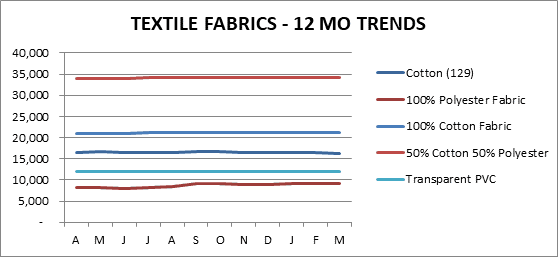

Most of Textile fabric prices were remained unchanged the first quarter. Except Polyester Fabric went up and Cotton went down slightly. Year over year, most prices are higher, with Polyester and PVC Leather up in price the most at 14% and 6.7% respectively and the rest up more modestly versus one year ago.

CERAMIC AND GLASS RAW MATERIALS

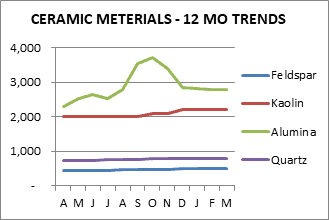

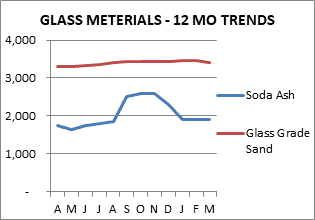

In Ceramic Raw Materials, Alumina prices down by 1.75% in the first quarter and Quartz, Kaolin and Feldspar remained unchanged, while in Glass Raw Materials Soda Ash was down in price sharply over 17% and Glass Sand marginally. Year over year, Feldspar is up in price by over 33%, followed by Kaolin up 10%, Alumina up 6.5% and Quartz up 5.3%, while Glass Grade Sand is lower by 21% and Soda Ash and Glaze both keep in price steady versus one year ago.

FUEL

Fuel prices in China were decline generally by 10%-24.7% in the first quarter and year over year, China Petroleum, LPG Gas and Natural Gas are decrease on average 10%. Furthermore, China Diesel Oil increase by almost 12% and China Industrial Electric has no change versus one year ago.

OCEAN FREIGHT

Ocean freight rates down sharply in Q1 with Shanghai/ Ningbo/Xiamen/Yantian to Chicago down over 30% on average and to Long Beach down over 49%. Year over year, Shanghai/ Ningbo/Xiamen/Yantian to Chicago are down by 29% on average and to Long Beach down over 55%.

COST OF LABOR

Asian labor rates saw increase trend in the first quarter except for China and Bangladesh remained unchanged. And for Thailand, Indonesia and Vietnam which jumped by 15%, 7.5& and 6% respectively. Year over year, rates are up in most countries with Thailand up the most (over 15%) followed by Indonesia (up 7.5%), Vietnam (up 6%) and China (5%) while Bangladesh saw no sign to change.

CURRENCY EXCHANGE RATE

For the first quarter, the USD strengthened slightly against the India Rupees, Indonesia Rupiah, Vietnam Dong and Bangladeshi Taka and weakened slightly against the China Yuan, Thai Baht and NT Dollars. Year over year, the biggest gains for the USD are against the Bangladesh Taka, Indonesia Rupiah, India Rupees and Vietnam Dong while its weaker against the Thai Baht, China Yuan and NT Dollar.

CHINA TRADE (Data lags by one month)

China Imports and Exports were both down significantly in the latest three months owing to the Lunar New Year holiday, down by 23.5% & 14.4% respectively. Year over year, China Exports are shoot up by almost 43% and China Imports are up by over 6.6% from year ago levels.

US Imports and Exports were both up slightly compared to last month.

Vietnam and Bangladesh Imports and Exports were both increased significantly with Vietnam Exports rose over 38% and Imports up over 35.4%, and Indonesia Exports up over 18% and Imports up by 20%. On the contrary, Indian and Indonesian Exports and Imports were all down compared to last month.

The China Producer Price Index (PPI) decrease by 2% in the first quarter while the China Consumer Price Index (CPI) rose by 1.2%. Year over year, the China PPI is down 3.8 % while the China CPI is up by over 2% versus one year ago.

PURCHASING MANAGERS INDEX (PMI)

PMI Indexes saw little change in the first quarter with Caixin China PMI Index has been climbing steadily throughout the quarter while China Federation of Logistics & Purchasing shows the higher index and USA PMI Index remained stable. But all were above 50 in Q1. Year-on-year, CFLP PMI Index is little lower. On the contrary, Caixin China PMI index and USA PMI show upward trends indicating growth and an expanding economy.

Download entire report: SI MANUFACTURING COST DRIVERS REPORT,2018Q1

CONTACT US FOR MORE INFORMATION

Thank you for taking the time to follow trends in Asia manufacturing. Source International has operational offices in Louisville, Kentucky & Xiamen, China. Our passion is to partner with companies in supply management from Asia. We have a 25 year on-the-ground track record, a rigorous operating procedure, and a very well trained local staff. We welcome the opportunity to show you how we can add value to your supply chain in Asia and invite you to visit our offices and website to learn more about us.

For additional details, please refer to the charts that follow or contact one of our Operations Specialists for more information. Thank you for your support.

Data for this report comes from the sources listed and while every attempt is made to be as comprehensive and accurate as possible, please consider that these are just general trends and you should not draw any specific conclusions from the data. We recommend that any information provided in this report be weighed against other sources and experts on the individual topics covered and\, accordingly, we make no specific claims nor assume any liability from the use of the data contained herein.

Comments are closed